Sales And Use Tax Form Arkansas . Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Purchasers pay sales tax on most tangible personal property on tax. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web the state sales tax rate in arkansas is 6.5%. The sales and use tax rates for arkansas are the same at 6.5 percent. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. Web sales and use tax forms. Web sales and use tax.

from formspal.com

Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web the state sales tax rate in arkansas is 6.5%. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web sales and use tax. Web sales and use tax forms. Purchasers pay sales tax on most tangible personal property on tax. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. The sales and use tax rates for arkansas are the same at 6.5 percent.

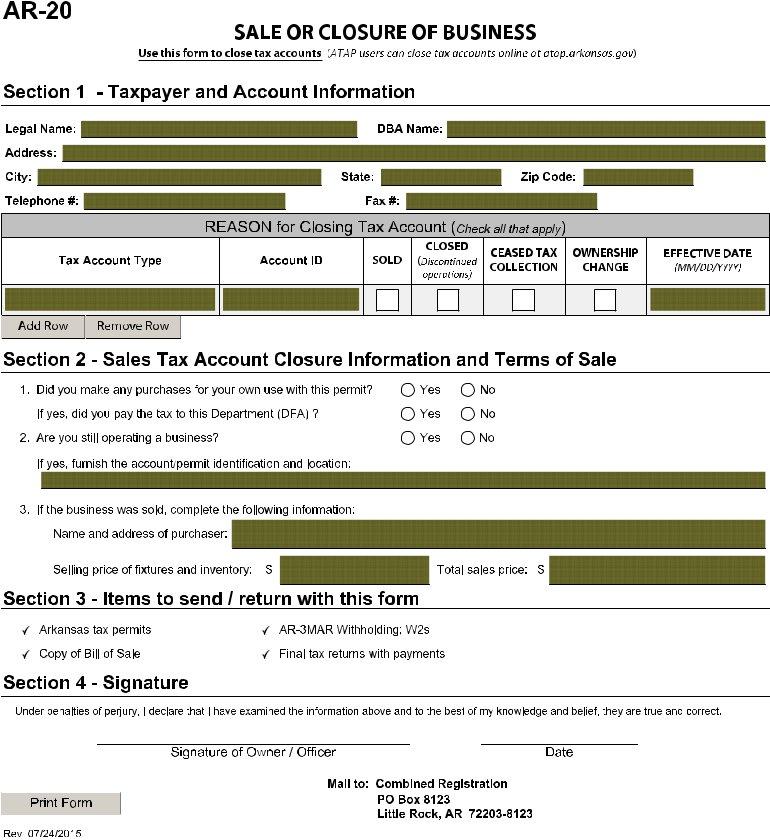

Ar 20 Form ≡ Fill Out Printable PDF Forms Online

Sales And Use Tax Form Arkansas Purchasers pay sales tax on most tangible personal property on tax. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web the state sales tax rate in arkansas is 6.5%. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. The sales and use tax rates for arkansas are the same at 6.5 percent. Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web sales and use tax. Purchasers pay sales tax on most tangible personal property on tax. Web sales and use tax forms.

From www.signnow.com

Ar4 20222024 Form Fill Out and Sign Printable PDF Template Sales And Use Tax Form Arkansas Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web sales and use tax. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web learn how to prepare your business to manage arkansas sales and use. Sales And Use Tax Form Arkansas.

From www.dochub.com

Streamlined sales and use tax agreement arkansas Fill out & sign Sales And Use Tax Form Arkansas Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web sales and use tax. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web once your business has an arkansas sales tax license and begins to make sales, you are. Sales And Use Tax Form Arkansas.

From www.uslegalforms.com

AR Instructions ET1 20202022 Fill out Tax Template Online US Sales And Use Tax Form Arkansas Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Purchasers pay sales tax on most tangible personal property on tax. The sales and use tax rates for arkansas are the same at 6.5 percent. Web the arkansas sales tax handbook provides everything you need to understand. Sales And Use Tax Form Arkansas.

From www.dochub.com

Arkansas sales tax registration Fill out & sign online DocHub Sales And Use Tax Form Arkansas Web the state sales tax rate in arkansas is 6.5%. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web learn how to prepare your business to. Sales And Use Tax Form Arkansas.

From www.formsbank.com

Form St1A Arkansas Application For Sales & Use Tax Permit Sales And Use Tax Form Arkansas Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting. Sales And Use Tax Form Arkansas.

From printableformsfree.com

Printable Arkansas State Tax Forms Printable Forms Free Online Sales And Use Tax Form Arkansas Web the state sales tax rate in arkansas is 6.5%. Web sales and use tax forms. Web sales and use tax. Purchasers pay sales tax on most tangible personal property on tax. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. The sales and use tax rates for arkansas are. Sales And Use Tax Form Arkansas.

From www.signnow.com

Tax in Arkansas Complete with ease airSlate SignNow Sales And Use Tax Form Arkansas Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Web the. Sales And Use Tax Form Arkansas.

From formspal.com

Ar 20 Form ≡ Fill Out Printable PDF Forms Online Sales And Use Tax Form Arkansas Purchasers pay sales tax on most tangible personal property on tax. Web sales and use tax. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. The sales and use tax rates for arkansas are the same at 6.5 percent. Web the arkansas sales and use tax section administers the interpretation, collection. Sales And Use Tax Form Arkansas.

From printableformsfree.com

Printable Arkansas State Tax Forms Printable Forms Free Online Sales And Use Tax Form Arkansas Web sales and use tax forms. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. The sales and use tax rates for arkansas are the same at. Sales And Use Tax Form Arkansas.

From eforms.com

Free Arkansas Bill of Sale Forms PDF eForms Sales And Use Tax Form Arkansas Web sales and use tax. Web sales and use tax forms. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Purchasers pay sales tax on most tangible personal property on tax. The sales and use tax rates for arkansas are the same at 6.5 percent. Web the arkansas sales and. Sales And Use Tax Form Arkansas.

From www.templateroller.com

Form CU1 Fill Out, Sign Online and Download Printable PDF, Arkansas Sales And Use Tax Form Arkansas Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Web sales and use tax. Purchasers pay sales tax on most tangible personal property on tax. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. Calculate the full sales and use tax. Sales And Use Tax Form Arkansas.

From www.pdffiller.com

2019 Form AR AR3 Fill Online, Printable, Fillable, Blank pdfFiller Sales And Use Tax Form Arkansas Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. The sales and use tax rates for arkansas are the same at 6.5 percent. Web the state sales tax rate in arkansas is 6.5%. Purchasers pay sales tax on most tangible personal property on tax. Web the. Sales And Use Tax Form Arkansas.

From www.formsbank.com

Fillable Form Et1 Sample Arkansas Excise Tax Return printable pdf Sales And Use Tax Form Arkansas Web the state sales tax rate in arkansas is 6.5%. The sales and use tax rates for arkansas are the same at 6.5 percent. Purchasers pay sales tax on most tangible personal property on tax. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web learn how to prepare your. Sales And Use Tax Form Arkansas.

From twitter.com

download arkansas use tax form pdf / Twitter Sales And Use Tax Form Arkansas Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. Web the arkansas sales and use tax section administers the interpretation, collection and enforcement of the arkansas sales and. Purchasers pay sales tax on most tangible personal property on tax. The sales and use tax rates for arkansas are the same at. Sales And Use Tax Form Arkansas.

From www.formsbank.com

Form St1 Arkansas Application For Sales And Use Tax Permit printable Sales And Use Tax Form Arkansas Web the arkansas sales tax handbook provides everything you need to understand the arkansas sales tax as a consumer or. Calculate the full sales and use tax rate (including local tax) by using the taxjar sales tax calculator here. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting. Sales And Use Tax Form Arkansas.

From www.pdffiller.com

2016 Form AR AR3 Fill Online, Printable, Fillable, Blank pdfFiller Sales And Use Tax Form Arkansas Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web the state sales tax rate in arkansas is 6.5%. Web sales and use tax forms. Web sales and use tax. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection,. Sales And Use Tax Form Arkansas.

From www.billofsale-form.com

Arkansas Bill of Sale Sales And Use Tax Form Arkansas Web the state sales tax rate in arkansas is 6.5%. The sales and use tax rates for arkansas are the same at 6.5 percent. Web once your business has an arkansas sales tax license and begins to make sales, you are required to start collecting sales taxes. Web sales and use tax forms. Web sales and use tax. Web the. Sales And Use Tax Form Arkansas.

From www.gencomarketplace.com

GENCO Marketplace Reseller Terms and Tax Licenses Sales And Use Tax Form Arkansas The sales and use tax rates for arkansas are the same at 6.5 percent. Web learn how to prepare your business to manage arkansas sales and use tax registration, collection, and filing. Web sales and use tax forms. Web the state sales tax rate in arkansas is 6.5%. Calculate the full sales and use tax rate (including local tax) by. Sales And Use Tax Form Arkansas.